Afterpay introduces ‘Money by Afterpay’ and announces Australian launch

- Written by Natasha Moate

Afterpay Australia Pty Limited today announced key details of its new money and lifestyle app Money by Afterpay (“Money app”) which will begin its roll out today with an Australian staff pilot. The Money app will mark the debut of Afterpay’s collaboration with Westpac just ten months after it was announced, setting the scene for a full Australian customer launch in October 2021.

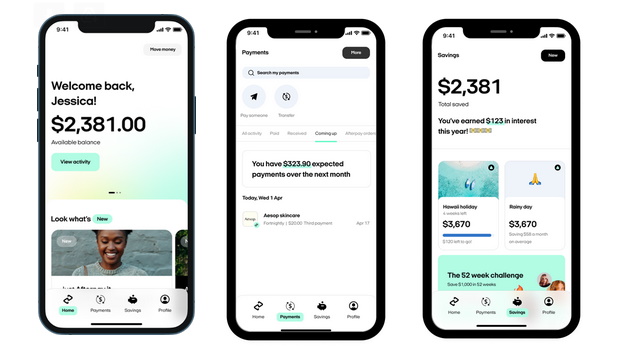

Once it is publicly available, customers must have an existing Afterpay BNPL account to get started and will use their Afterpay credentials3 to log into the Money app. Within minutes of opening an account, customers can make it their primary money management app. The Money app’s home carousel will display their BNPL balance, upcoming orders and installments alongside their daily spending account and savings accounts, giving customers a single, seamless view of their finances.

Savings made simple with 1% p.a. interest rate

The Money app will include a simple, yet compelling, savings offer to customers to help ease the mental load so often associated with navigating complex requirements and terms and conditions just to receive a decent interest rate.

The Money app customers can earn a competitive interest rate of 1% p.a. on up to 15 different savings accounts. The benefit of having so many different savings accounts is to allow customers to open separate accounts for different savings goals, and to purchase different things based on their specific needs - large and small - from a house deposit to a new doona.

To receive the interest rate, customers simply have to have money in any one of their savings accounts. There are no special requirements such as ensuring your savings balance is higher at the end of the month than at the start. The interest rate of 1% p.a. can be earned up to $1,000,000 in each of the 15 savings accounts.

Money basics with no fees4

The Money app offers one daily account with a physical debit card, digital wallet offerings and the ability to easily make and receive real time payments (via the New Payments Platform).

In addition, it is proposed that the daily account will not charge customers fees, making it an ideal primary account for customers to directly deposit their salaries and view their complete financial position in one place. As the app gets closer to its full public launch in October, more insights and features will be introduced to further help customers make more informed spending and saving decisions.

Helping customers build confidence, starting with savings

The Money app has been designed to help customers build financial confidence by equipping them with a money management experience better suited to their lives - starting with a real focus on savings.

To guide the direction for the Money app, more than 1,400 hours of in-depth research with customers across key markets globally was conducted, including detailed money diary studies which logged more than 10,000 data points, including transactional data, comments, records and pictures. The research demonstrated that there is a large cohort of Gen Z and Millennial customers who don’t trust their own money behaviours, and therefore lack confidence in using or committing to other apps on the market.

Fundamentally, customers indicated that control over savings was the key to envisaging a greater financial future for themselves. However, the current offerings in the market around savings feel unnecessarily complex and inaccessible, or not suited to their needs. This insight around helping customers trust themselves is what drove the development of the Money app.

Afterpay Co-CEOs Anthony Eisen and Nick Molnar, said:

“Afterpay has always stood apart in the way it connects with customers around common core values of simplicity, transparency and trust. Ultimately, with Money by Afterpay, our goal is to make managing your money simple, frictionless and stress-free.

“Money will broaden our relationship with our loyal customers and also attract a new group that’s looking to streamline how they manage their finances within the debit economy, further cementing our commitment to supporting responsible spending.

“To bring a money app to life in ten months demonstrates that we can quickly move at pace to get well ahead of customer expectations and bring both cutting-edge features and true ‘surprise and delight’ to the experience.”

Afterpay Executive Vice President, New Platforms, Lee Hatton said:

“We’ve built upon the trust and love of the Afterpay brand to bring Gen Z and Millennials a money and lifestyle app that’s truly built for them. Combining money management with the BNPL offering will allow us to help customers spend, save and play just by using Money as their primary app.

“The first release in July is just the beginning for us. We will deliver new and unique features to customers consistently throughout the year and we'll be nimble enough to quickly act on feedback in near real-time. We can’t wait to share this with Australians.”

July launch experience builds to public launch

Employees will test the experience in July and a series of feature drops will follow in the weeks leading up to the public launch. Feedback and insights from this closed group will further refine the content, experience and feature set offered publicly in the second quarter.

In addition to Westpac as the regulated deposit account and card issuer, Afterpay has obtained an Australian Financial Service License (AFSL) from the Australian Securities and Investments Commission to enable it to provide general financial product advice and distribute basic deposit products and debit cards.

About Afterpay Limited

Afterpay Limited (ASX: APT) is transforming the way we pay by allowing customers to receive products immediately and pay for their purchases over four installments, always interest-free. The service is completely free for customers who pay on time - helping people spend responsibly without incurring interest, fees or extended debt. As of March 2021, Afterpay is offered by nearly 86,000 of the world’s favourite retailers and has more than 14 million customers globally.

Afterpay is currently available in Australia, Canada, New Zealand, the United States and the United Kingdom, France, Italy and Spain, where it is known as Clearpay. Afterpay is on a mission to power an economy in which everyone wins.

Money by Afterpay is a product from Afterpay Australia Pty Limited (AFSL 527911 ABN 16 169 342 947), with accounts and debit cards issued by Westpac Banking Corporation (ABN 33 007 457 141, AFSL 233714). Any advice has been prepared without taking into account your objectives, financial situation or needs. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation or needs.